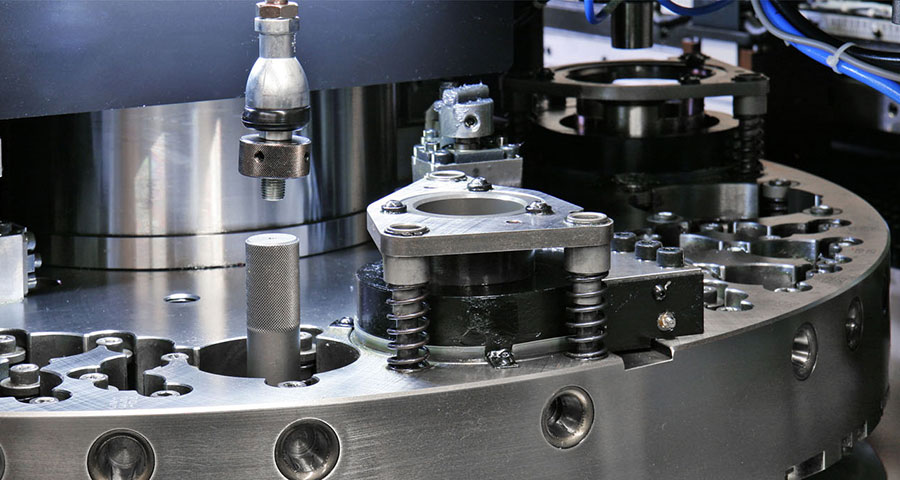

Manufacturing & Logistics

Banking That's Responsive and Efficient

Manufacturing and distribution companies know how important it is to have the right resources at exactly the right time. Our experienced bankers can help you streamline your operation, with the responsiveness and efficiency that are key to helping your business stay ahead.

Manufacturing & Logistics Solutions1

With a strong local commitment to manufacturing and distribution companies, backed by sizable national resources, Western Alliance Bank offers a wide array of banking and financing solutions. From simplifying capital investment decisions to optimizing liquidity, our customer-focused approach also means you get a dedicated, experienced relationship manager to help with all your unique banking needs.

- Business Checking & Savings: Optimize more transactions for better cash management

- Commercial Loans & Credit: Optimize working capital and liquidity

- Treasury Management: Monitor and manage cash flow

- Equipment Finance: Finance upgrades and expansion through CAPEX lines of credit

- Global Markets Services: Obtain pre-export financing

Scott Roberts Veterans Trading CompanyWe were looking for a bank that provided more personalized, relationship-based service that was a fit for our company. That was Western Alliance Bank.

Reach a Banker

Contact Our Manufacturing & Logistics Team

Contact Us1. All offers of credit are subject to credit approval, satisfactory legal documentation, and regulatory compliance. Borrowers are responsible for any appraisal and environmental fees plus customary closing costs, including title, escrow, documentation fees and may be responsible for any bank fees including bridge loan, construction loan, and packaging fees.