Our Juris Banking Group offerings include Settlement Services for class action, mass torts and bankruptcy attorneys, claims administrators and related businesses; Digital Disbursements to facilitate payments to claimants in these matters; Bankruptcy solutions for court-appointed trustees, debtors in possession, receivers, and fiduciaries; and nationwide full-service banking solutions under the same umbrella. Our team combines legal expertise and a dedication to client service that delivers value and exceeds expectations.

Digital Payments in Class Actions and Mass Torts

While fraudulent claims have always existed in class action and mass tort settlements, the problem has grown exponentially worse over the last two years, according to exclusive research by Western Alliance Bank and Digital Disbursements. Download our research report based on information from 597 class action and mass tort distributions handled through 24 different settlement administrators between 2019 and 2023.

A Banking Service That Has No Precedent

The legal profession has long been bound by tradition, but change is coming. NewLaw Banking has been built to meet the complete banking needs of law firms, legal technology providers, and other businesses that are adapting to—and driving—change in the market for legal services. They are transforming the way legal services are delivered for the better, and winning because of it.

Complete Banking Solutions for NewLaw Businesses

We offer comprehensive banking services to all NewLaw Banking clients, from partner buy-in loans for large and boutique law firms to assistance with early-stage financing for legal techs. All our solutions are delivered with a deep understanding of the new legal landscape and a white-glove approach to client service.

Full-Service Banking Solutions for Legal Tech Companies and Alternative Legal Service Providers

Drawing on our deep knowledge of the legal technology market, we provide full-service banking solutions to legal tech providers and ALSPs, including products and services to support them through start-up, early growth, and corporate financings.

Full-Service Banking Solutions for Law Firms

NewLaw Banking provides a full suite of banking products for law firms, including business checking1, savings2, as well as a wide spectrum of loan and financing options3, such as attorney lines of credit, IOLTA4 accounts and treasury management5. It is our mission to help forward-thinking law firms with capital needs for initiatives, including:

- Loans for attorneys to launch a new firm

- Expansion into new practice areas or office locations

- Development of innovative legal service tools

Lending Solutions for the Legal Industry

Our team understands that running a contingency or hourly billing based legal business requires flexible and reliable sources of funding, and we work with law firms and other NewLaw businesses of all sizes to facilitate stability and growth.

- Working Capital Lines of Credit provide on-demand funds for irregular cash cycles and operating expenses. Lines are tailored to your business needs with flexible terms and repayment timelines.

- Corporate Card Programs to manage business development expenses and accounts payable customized to your needs.

- Partner Buy-in Solutions to empower new partners to share in equity with flexible loan options and repayment terms.

- Term Debt Structures to fund capital expenditures, innovation initiatives, and expansions with loans that have flexible durations and payment terms.

- Case Cost Funding to complement other third party litigation financing options.

Treasury Management Services for the Legal Industry

Western Alliance Bank offers treasury management solutions that are customized for each client to optimize cash flow, payables management, interest earned and fraud protection, all delivered with a white-glove, consultative approach. Our team is well-versed in legal industry best practices and serves as an extension of your settlement administration team.

- Cash Position Reporting to easily access account balances

- Corporate Cards to simplify cash flow and expenses

- Developer Hub to automate banking information and actions

- Complete Treasury Offerings to better manage your business

A Wealth of Industry Knowledge

We aren’t just bankers to the legal profession. We’re students of the fast-evolving changes in the business of law. We’re watching as pressure from corporate clients, new market entrants, and other forces are pushing law firms to deliver more efficient services—and creating business opportunities for those who can meet these demands for greater productivity.

Specialized Banking for Class Action & Mass Tort Settlements

Western Alliance Bank is your resource for specialized banking for law firms, claims administrators and related businesses managing complex class action, mass tort and bankruptcy settlements. Our committed team brings you decades of expertise in supporting all phases of the settlement process, from escrow through distribution, with industry-leading digital payments provided by our subsidiary, Digital Disbursements. Through your single point of contact, you’ll find a highly personalized banking experience with a focus on exceptional service, flexibility and integrity.

Banking Tailored to the Legal Profession

With Western Alliance, you’ll find customized business banking products and solutions to meet the needs and timelines of your firm.

- Escrow depository agent

- Qualified settlement fund (QSF) banking

- General litigation settlement fund banking

- Bankruptcy receiverships and court-appointed monitorships

- Simple-to-complex attorney-focused fiduciary accounts

- Operating and IOLTA accounts

- Financing for working capital and case costs

- Customized treasury management services

- Streamlined, same-day turnaround for new accounts after initial setup

Building Community in the Industry

We’re dedicated to building a community in the legal industry where practitioners of all levels can come together to discuss the evolution of class action and mass tort litigation. The Western Alliance Bank Class Action Law Forum™ is an annual conference held in collaboration with University of San Diego School of Law. Each year, attendees hear new and relevant insights from speakers and panelists such as sitting federal judges, along with top defense and plaintiffs’ attorneys.

Class Action Law Forum™

Western Alliance Bank's annual Class Action Law Forum (CALF) is held in collaboration with University of San Diego School of Law and directly benefits the Western Alliance Bank Scholarship Fund supporting a USD Law School student in financial need. Each year attendees hear new and relevant insights from speakers and panelists such as sitting federal judges along with top defense and plaintiffs' attorneys. To learn more about our Class Action Law Forum, see below.

Increase Payment Success Rates While Reducing Distribution Cost

Western Alliance Bank’s innovative digital disbursement technology addresses the evolving payment needs for class actions, mass torts and bankruptcy payments in the legal industry. Digital Disbursements, a proprietary platform and a subsidiary of Western Alliance Bank, enables claimants to choose how they would like to receive their payments, with options ranging from direct-to-bank account to popular digital wallets.

Digital Disbursements can significantly increase payment efficacy, reduce unclaimed funds, and by limiting the use of paper checks, also limit distribution costs. Our platform can also reduce potential fraud through machine learning, strong risk management infrastructure and digital fingerprint analysis.

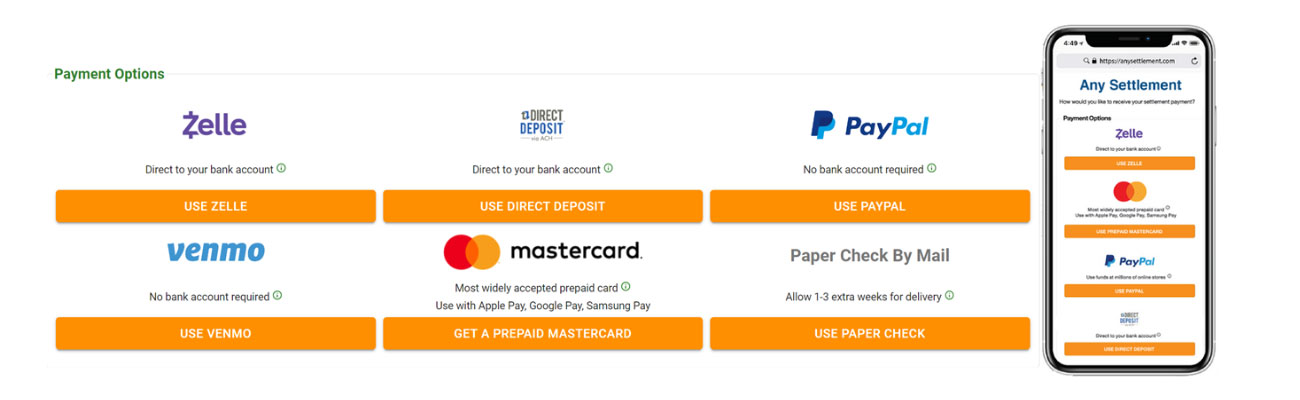

We offer the widest array of digital payment options to not only simplify payments, but also solve one of the biggest issues in settlement fund distribution getting payments into the hands of unbanked claimants, who are often required to pay high fees for check-cashing services. Our pay menu options include Zelle, Venmo. PayPal, Mastercard Prepaid Cards, and traditional methods including Direct Deposit, and Paper Check by Mail.

To learn more about our Digital Disbursements or to request a demo of our platform, please contact Jeff Richardson at [email protected]

Specialized Banking for Bankruptcy

Court-appointed trustees, debtors in possession, receivers, bankruptcy management companies, advisors, committees and fiduciaries involved with bankruptcy matters face all types of challenges when fulfilling their obligations. That’s why so many of them turn to Western Alliance Bank’s Bankruptcy team. We provide exceptional responsiveness, reach, security and treasury management solutions to ensure funds are managed and administered appropriately throughout every step of the process.

Banking Designed to Maximize Bankruptcy Process Efficiency

With Western Alliance, you'll find a partner that helps support you and your client's banking needs, enabling you to deliver optimal results to your stakeholders.

Advantages for Chapter 7 and 11 Bankruptcies and Receiverships

- Western Alliance Bank is an authorized depository institution in all 21 U.S. Trustee Regions.

- Streamlined process to quickly onboard new accounts.

- Experienced team who understands the intricacies of the bankruptcy process allowing our clients to take advantage of quick-turn opportunities and achieve the best possible outcomes.

- We have built strong relationships with financial advisors, attorneys, and other bankruptcy professionals allowing our team to stay current with nuanced bankruptcy processes.

- Treasury Management Services designed to meet your specific needs and those of your clients, including information reporting, accounts payable and accounts receivable, and fraud protection, giving you peace of mind and creating efficiencies to allow your business to grow.

What Sets Us Apart

- We're experts who recognize the unique opportunities and challenges facing your business.

- When questions or concerns arise, we understand the urgency and prioritize getting our clients the answers they need when they need them. Our team is committed not only to responding rapidly but also to having the acumen and authority to make prudent decisions quickly.

- We make it our business to know your business so we can provide customized solutions to help you grow and succeed.

- We're known for providing personalized attention. Your single point of contact is an expert in the bankruptcy process and will work. closely with you on all your banking needs.

Experience Matters

Our team is like you. We’re innovative, entrepreneurial professionals who have observed changes in the legal profession and decided to lead them rather than follow. And like you, we’re unique. Western Alliance Bank has assembled a commercial banking group completely dedicated to serving NewLaw businesses.

NewLaw Banking

1. Refer to the disclosures provided at account opening and the Schedule of Fees and Charges for additional information.

2. Withdrawal transaction limits apply. Refer to the disclosures provided at account opening and the Schedule of Fees and Charges for additional information.

3. All offers of credit are subject to credit approval, satisfactory legal documentation, and regulatory compliance.

4. Inquire with a relationship manager to confirm we are approved to offer IOLTA accounts in your state.

5. All offers of credit subject to credit approval. Some products and services may be subject to prior approval or fees. Please contact a Treasury Management Advisor and Relationship Manager for additional details that may apply based on products and services selected.