End-to-End Escrow and Digital Payments Solutions From Industry Experts

For paying agent and escrow services during M&A or other business transactions, you need experienced, reliable and flexible solutions. We offer highly customizable, responsive service from a single provider, addressing all of your pre- and post-closing needs.

Merger and Acquisition Services

Our M&A Payments and Escrow Services group consists of industry experts who provide a complete slate of end-to-end escrow and digital paying agent solutions designed for M&A transactions. We make it our business to know as much as possible about your transactions so that you can execute them with ease and accountability, providing a seamless process for all involved parties.

Our expert M&A team manages transactions simply and efficiently.

- Fully digital process: Eliminate pre-closing printing and mailing of paper-based documents with easy, secure document signing via DocuSign — anytime, anywhere.

- Streamlined third-party consents: Quickly and conveniently obtain, tally, report and download executed documents such as a stockholder consent to keep your transaction on track.

- Robust tax reporting: Outsource all elements of tax reporting required in connection with your M&A transactions.

- Single source for M&A services: We can serve in various roles including escrow agent, disbursing agent, paying agent or solicitation agent.

- Secure online portal: Western Alliance Bank's Gateway, our industry-leading online payments platform, facilitates document collection in any spreadsheet format, with intuitive technology to enable accurate and timely disbursements.

- Robust international payment capabilities: When you need to conduct international transactions, we can craft a plan to suit your needs, with full foreign exchange (FX) service.1

Escrow Services

You can call on us for any business escrow service that you require — including M&A escrows, project financing or other business-related escrows.

- Accelerated onboarding: We require Know Your Customer (KYC) information only from the depositing entity. Accounts can be opened in one business day, and funding can take place immediately thereafter.

- Single-wire funding: Fund any one account, and your team will manage the flow of funds. We can aggregate your transaction against escrow funds, security holders and transaction expenses.

- Enhanced yield opportunity: While your escrow funds are on deposit for weeks, months or longer, you deserve to earn a healthy yield. We endeavor to offer the best yield in the market to qualifying escrow accounts.

- Easy paper: We review and turn most transaction agreements within 24 hours and are known for using a logical approach to contract negotiation vs. a one-size-fits-all risk umbrella.

- FX capabilities: Need to fund your transaction in an alternative currency? No problem. We offer a competitive foreign exchange offering to convert escrow cash to U.S. dollars.

- No fees on cash escrow accounts. We do not charge fees for qualifying cash escrow accounts — eliminating the need to negotiate which party is responsible for escrow account fee(s).

Key Points

You will benefit from our:

- Dedicated team focused solely on M&A and business escrow services.

- Customizable escrow agreements; we tailor our capabilities to your transaction’s unique circumstances.

- Competitive deposit options and fee structures.

- Online statements and robust reporting.

- Deep experience executing high-value, complex transactions across the globe.

- Reliable and efficient payment solutions.

Full-Service Escrow Solutions Backed by Experience

When you work with our Business Escrow Services team, you gain a client-focused relationship manager and the advantages of comprehensive payments and escrow solutions, all within the structure of an award-winning financial institution focused on business transactions.

Key Benefits for Your Business

- Same-day escrow releases: Our expedited process requires Know Your Customer (KYC) information only from the depositing entity. Deposits can be accepted the same day you open your account.

- Dedicated team: Our experts are focused on executing your transaction, with working hours that keep pace with your deal. You receive reliable, responsive service from a single contact who knows your business inside and out.

- Same-day review of agreements: We quickly prepare and review customized or standard template agreements to meet your needs.

- Customized capabilities: No two deals are the same. We tailor our service to your transaction’s unique needs, addressing material factors for you.

Our Escrow Services

Our Business Escrow Services group offers:

- All types of escrow transactions, including M&A escrows, real estate escrows, construction escrows, good faith deposits and holdback escrows.

- Single post-closing provider to combine closing, paying and disbursing agent services with escrow administration.

- Specialized transactions in settlements, private equity and venture capital.

- Unvested or restricted cash holdbacks.

Solutions That Work for You

- Competitive deposit options with enhanced yield opportunities and a competitive fee structure.

- Transparent reporting through online statements and our industry-leading online payments platform, Western Alliance Bank's Gateway.

- Global Markets and foreign exchange (FX) capabilities.1

- Specialized escrow services for large legal cases through Western Alliance Bank’s Settlement Services group.

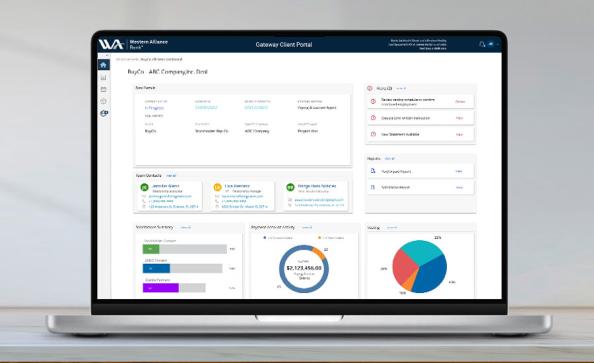

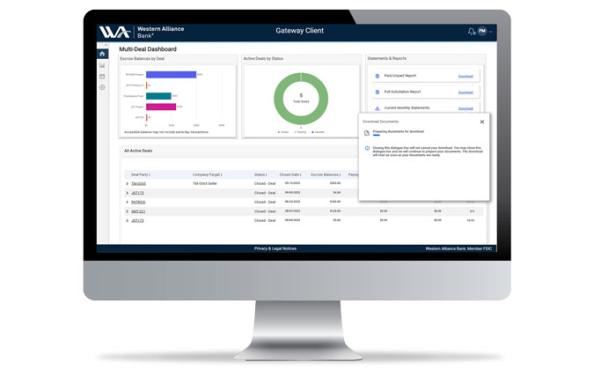

Our Digital Information Hub Makes Taking Care of Business Easy

Western Alliance Bank's Gateway is an easy-to-use, industry-leading digital paying agent platform that simplifies and accelerates complex M&A transactions. Our online payments platform, Gateway, facilitates secure document execution and collection – anytime, anywhere. Our single-point information hub provides buyers, sellers and attorneys real-time information on solicitation, payment status’ and more.

Through Gateway, M&A parties can manage transactions simply and efficiently, with improved speed and transparency for buyers, sellers and agents.

Key Benefits for Your Business

- 24/7 access to documents, including mobile-friendly login.

- Unique user capabilities, including complete customization of documents and securityholder experience.

- Privacy protection through the Gateway platform.

- Intuitive technology that provides for accurate and timely disbursements.

- Secure online document signing to eliminate printing and mailing paper-based documents before closing.

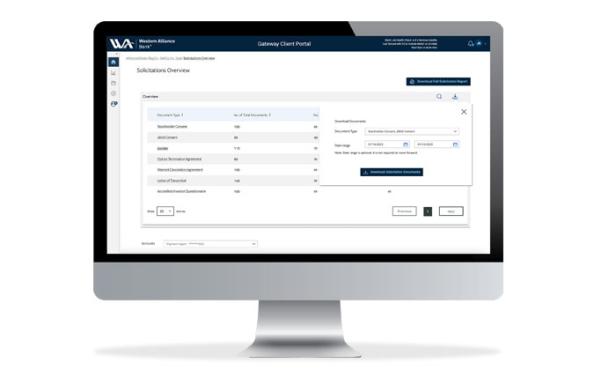

- Built-in voting, tallying and reporting functionality to streamline third party consents.

- Full-service year-end tax reporting.

How It Works

We’ll help you:

- Digitally distribute and obtain executed documents.

- Pay shareholders faster.

- Monitor transaction status from one secure portal.

- Conduct and tally shareholder votes or other documents associate with third-party consents.

- Securely collect shareholder tax information.

- Manage compensation payments for former employees.

- Manage restricted or unvested cash vesting schedules.

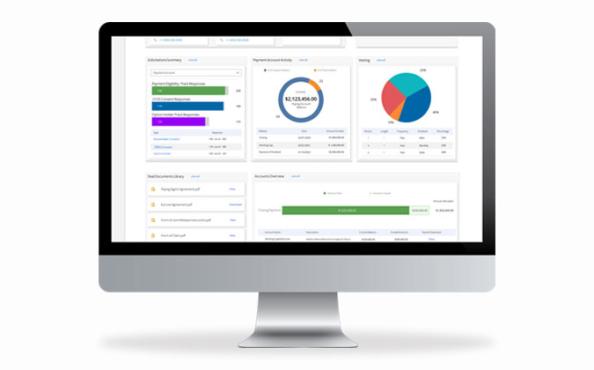

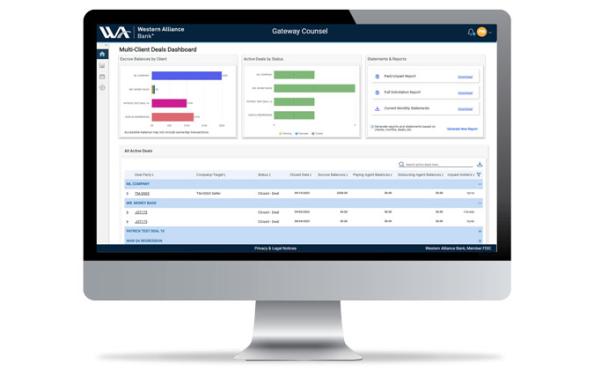

Deal Management Made Easy

Western Alliance Bank's Gateway is a sophisticated, user-friendly digital solution that simplifies and accelerates complex M&A transactions with one intuitive platform.

A global view of all deals associated with a user creates a single-point information hub for buyers, sellers and their counsel with real-time information on solicitation, payment status and more.

Obtain or view reports in addition to real-time access functionality to securely access all documents executed by securityholders in bulk or based on time of completion.

With Gateway's suite of portals, M&A parties can manage transactions simply and efficiently, with improved speed and transparency for buyers, sellers and counsel.

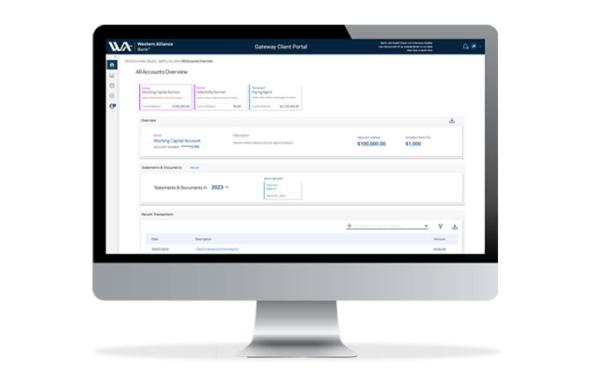

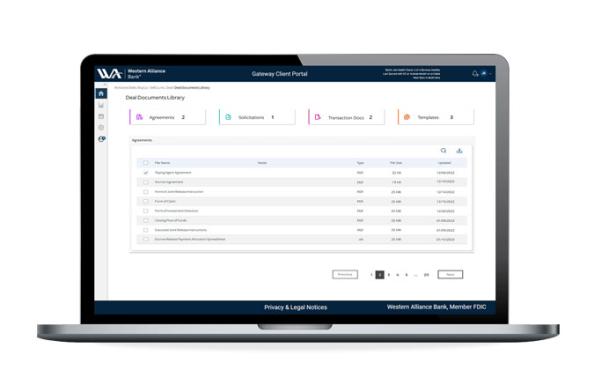

Document Inventory Made Easy

Gateway provides immediate access to forms of agreements, joint written instructions, release templates and the closing flow of funds. Additionally, provisioned access allows authorized parties to easily access the account statements, determine interest earned to date and reduce post-closing email traffic.

Review and Monitor Solicitation Progress

Customize the securityholder content and experience in either one or multiple solicitations, and use Gateway to track the response rate as you work towards the requisite threshold to get to closing.

View documents assigned to each securityholder based on the security type.

Expertise, Transparency and Responsiveness

Western Alliance Bank’s Business Escrow Services group delivers comprehensive solutions that provide not only a seamless closing process, but an all-encompassing approach to supporting your post-closing activities as well. Receive unparalleled transparency on your transactions with innovative, tailored solutions from a team of ultra-responsive experts with deep experience closing large deals across the globe.

With extensive expertise on all buy-side related touch points, our team knows serial acquirers: we understand your needs, your pain points and how we can add value to your processes. Led by Heather Kelly, who brings over two decades of buy-side expertise and execution to the table, our team consists of former M&A lawyers and tenured, money-center bankers who utilize a technology- and relationship-focused approach to every deal.

We’ve built buyer-focused solutions that allow your teams to increase continuity, drive efficiency and create a true partnership of support with your agent throughout the deal process, including post-closing. We are your dedicated solution to complex transactions, whether your deal is here in the U.S. or is cross-border. We can clear KYC and open accounts typically within one business day. We allow our serial acquirers to use the forms of agreement they are comfortable with.

Solutions for Your External Counsel

Western Alliance Bank has launched the first digital solution of its kind, geared towards external counsel: Gateway Counsel. Your counsel can access real-time information on solicitation, payment status and account balances, as well as calendarize events associated with your transactions.

Solutions for Your Treasury Team

- Streamlined flow of funds.

- Access to full reporting.

- Quick access for auditors to obtain year-end data without the hassle of chasing an agent to provide it.

- Easily view current statements across all accounts and deals with a single click.

- Real-time 24/7 access to balances, interest and tax statements.

Solutions for All Your Internal Teams

Western Alliance Bank understands post-closing execution reaches far beyond your internal counsel, which is why we’ve created solutions to easily organize and share deal information with your expanded teams across various corporate functions.

Vesting Schedule Management

We coordinate with your HR, legal and payroll teams to remove the obstacles associated with having founder holdbacks subject to continued employment while in escrow.

Customized Accessibility Across Your Internal Teams

Online portal access to pending, current and historical deals, creating a single-point information hub with real-time data around solicitation, payment status, account balances and access to online statements. You have access to key forms, templates and statements with a customized global view of all your deals in one transparent hub. Dashboards can be customized and bifurcated across your legal, treasury and tax teams so each team only has access to the information it needs.

Full Tax Reporting Capabilities

We handle imputed interest calculations, removing the burden from your tax team on escrow releases. We apply tax law on all payments to eliminate the need for your tax team to direct withholding.

Deal Support on Israeli-based Transactions

Israeli transactions are complex. We understand the nuances of coordinating with Israeli trustees, paying agents and counsel, so we provide continuity by acting as an intermediary across the various parties. Whether there are U.S. payments that require reporting, you need assistance obtaining Israeli tax exemptions required by the trustee or you simply need a streamlined approach to maintain consistency – we have you covered.

Online Portal for Securityholders

The experience of the shareholder exit on your acquisition is paramount to a successful deal. Our secure shareholder portal, Gateway Shareholder, is used to collect documents and obtain payment instructions and tax information. It has become increasingly important with the rise in cybersecurity threats to ensure delivery of the data required to make payments is protected. We make payments at closing accurately and quickly.

Professional Expertise & Resources

Our Business Escrow Services Team

When you work with our Business Escrow Services team, you gain a client-focused relationship manager and the advantages of comprehensive payments and escrow solutions, all within the structure of an award-winning financial institution focused on business.

About Us

Contact Us

Our team of leading professionals has significant industry experience with a presence from coast to coast. As a specialized, trusted resource for strategic buyers, leading law firms, exiting companies and other deal constituents, our in-depth experience combines with expert, personalized service and innovative escrow and payment solutions to meet the needs of clients nationwide.

55 Almaden Boulevard

Suite 100

San Jose, CA 95113

United States

1. Fees may apply. Refer to the disclosures provided at account opening and the Schedule of Fees and Charges for additional information.